Below is a list of the documents that you need to upload as PDF’s. Underwriting can not use photo’s or screenshots from a phone so you will need to turn your phone into a scanner if you do not have a scanner at your home.

You can use this app to scan documents into PDF forms using your phones camera. You do not have to pay for these apps to use them.

Camscanner click her for Android

Camscanner click here for iPhone

Here is a video that teaches you how to use camscanner in less than 5 minutes.

How to use Camscanner click here

Now that you have a way to copy and send your documents, here is what we need:

- 30 Days of paystubs from all current jobs

- Two years of w-2’s for any job you have worked in the last two years.

- 60 days of bank statements, all pages with your name and account number(see example below)

- Contact info for your current HR person that can verify your employment.

- Home Owners insurance contact if you have one. If you do not, please call Craig Cold once you have a home under contract at 651-462-7103 as he offers great insurance at the best prices we have seen on both home and auto.

- If you are self employed, 2 years of your Federal Tax returns with all schedules.

If you are doing a refinance we will also need a copy of your current mortgage statement.

- With a refinance, we need to know you initial loan date and first payment date as well as your current interest rate and original loan amount.

If you have done a full loan application then you can upload your documents. If you have not done the application yet, you will need to email the documents to me.

Create an account using this link so you can upload your documents:

Click Here to Upload your documents

https://www.supremelending.com/borrower-portal

In general if you are going to upload a transaction history vs bank statements these are the rules.

Requirements for Transaction Histories:

The following must appear on transaction histories:

- The Borrower AND Bank/Institution Name must be present

- If printed online, the URL must be present

- If printed at the bank, it must be signed, dated and stamped by a banker

- At least the last 4 of the account number must be present

- The transaction history must go back to the ending date of the most recent bank statement (if applicable).

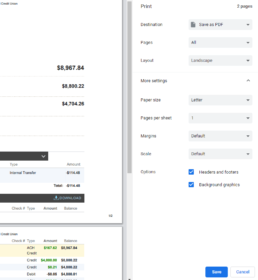

If you are using Chrome, when you click to print, you will have several options on the side that say, more settings and then you can check the two boxes that say print headers and footer and print background graphics.

Here is an example of the URL that will show at the bottom of each page which shows underwriters that the page is real.

Things to know when you are gathering your documents for your loan.

Statements

You must include all pages front and back even if they are blank

If you have a transaction printout it needs to have the url printed on each page if you get it online. There is an example above. If you get it from the bank, it must be signed/stamped on each page.

If you look at the printout above, it has the url at the bottom of the page it might also say how many pages there are. If either of these are missing, the document will be rejected.

The following is from a bank statement, the xxx would be a real account number. As you see, if you do not have 9 pages in the pdf, then the statement would be rejected

If you look at the bank printout below, it will need to have name, account number, balances, number of pages as well as being stamped by the teller. We see that the statement below is from John A Doe account number would be where the xxxxxxxxx

You will be asked about every deposit that is on your account. 99.999% of the time, underwriting will not allow any money that was deposited in cash or that you can not document. Examples of things that will be rejected:

i. Cash deposits

ii. Check deposits from selling stuff that you do not have a signed receipt and contact info from the buyer.(it still may be denied even with this documentation)

iii. Deposits that you can not document.

If you have 5,000 dollars in your account and you have three 700 dollar cash deposits from your roommate, they may not allow 2,100 dollars so you will only have 2,900 dollars that you can use towards your down payment and closing costs.

In some cases, you will have to use docusign to sign a document electronically from your phone or computer.

Here is a short video showing you how to do it.

Here is a time frame of the loan process once you have your documents uploaded.